Navigating the intricate earth of taxation can be daunting For a lot of folks and organizations alike. Tax obligations can swiftly turn out to be mind-boggling, leading to a necessity for productive tax reduction methods. Tax aid refers to the numerous methods and mechanisms by which taxpayers can minimize the amount of tax owed or hold off tax payments. These methods can offer Significantly-required economical reprieve, especially for those experiencing mounting tax debts. Comprehension tax aid possibilities is essential in guaranteeing that taxpayers usually are not burdened by their tax liabilities, allowing for them to handle their funds much more proficiently.

1 prevalent scenario the place tax aid gets to be necessary is when individuals or firms are scuffling with substantial tax credit card debt. In these types of instances, tax resolution gets a significant Software. Tax resolution entails negotiating with tax authorities to settle tax debts, usually leading to a discount of the overall amount of money owed. This method demands a deep understanding of tax regulations as well as a strategic approach to managing tax authorities. Tax resolution will take quite a few varieties, together with installment agreements, features in compromise, and penalty abatements. Each of such solutions features another pathway to resolving tax challenges, based on the particular circumstances of the taxpayer.

A noteworthy situation that highlights the significance of tax aid and tax resolution is Doe vs. Tax Increase Inc. This situation exemplifies the difficulties that taxpayers can face when addressing tax authorities. In Doe vs. Tax Increase Inc., the taxpayer was at first confused because of the needs of the tax authority, bringing about considerable tension and economical strain. However, via a nicely-prepared tax resolution method, the taxpayer was able to negotiate a far more favorable end result. The situation of Doe vs. Tax Rise Inc. serves being a reminder that efficient tax resolution may make a substantial change in the outcome of tax disputes.

When it comes to tax relief, it is necessary to acknowledge that not all relief selections are created equal. Some procedures, like tax deductions and credits, right reduce the amount of tax owed, while others, like deferments, delay the payment of taxes. Taxpayers should evaluate their scenario meticulously to pick which tax aid methods are most acceptable. For illustration, a taxpayer facing quick fiscal hardship may well benefit from a deferment, whilst a person with important deductions may well choose to center on maximizing All those to reduce their tax legal responsibility. Being familiar with the nuances of such selections is vital to making informed decisions about tax aid.

Tax resolution, Conversely, normally involves Qualified support. Negotiating with tax authorities could be a complex and overwhelming system, and acquiring a highly trained tax Specialist in your facet may make a major distinction. In several situations, tax resolution specialists can negotiate better phrases compared to taxpayer could achieve by themselves. This was evident in Doe vs. Tax Rise Inc., where the taxpayer's prosperous resolution was largely mainly because of the skills in their tax advisor. The case underscores the value of looking for Experienced aid when addressing significant tax challenges.

As well as Experienced help, taxpayers must also be familiar with Tax Resolution the assorted equipment accessible to them for tax aid. These tools can incorporate tax credits, deductions, and other incentives created to lessen tax liabilities. Such as, tax credits straight lessen the quantity of tax owed, building them one of the most effective types of tax relief. Deductions, Alternatively, lessen taxable profits, that may lessen the general tax Monthly bill. Being familiar with the distinction between these instruments And just how they are often utilized is essential for efficient tax preparing.

The Doe vs. Tax Rise Inc. circumstance also highlights the necessity of keeping knowledgeable about tax regulations and laws. Tax laws are constantly switching, and what may perhaps are a feasible tax relief or tax resolution system in past times may possibly no longer be relevant. Taxpayers want to stay up-to-day with these improvements to be sure They're Profiting from all readily available tax relief selections. In the case of Doe vs. Tax Increase Inc., the taxpayer's knowledge of new tax law improvements was instrumental in attaining a positive resolution. This situation serves for a reminder that staying knowledgeable might have a major influence on the outcome of tax disputes.

One more critical facet of tax reduction and tax resolution is the timing. Acting immediately when tax challenges come up can avert your situation from escalating. In Doe vs. Tax Rise Inc., the taxpayer's timely response on the tax authority's requires performed a crucial part from the successful resolution of the case. Delaying action can result in more penalties and desire, making the situation even harder to solve. For that reason, it can be important for taxpayers to deal with tax difficulties once they crop up, rather than ready until the issue gets to be unmanageable.

Although tax relief and tax resolution can offer sizeable benefits, they don't seem to be without the need of their worries. The procedure is often time-consuming and calls for an intensive understanding of tax laws and polices. Also, not all tax reduction choices are available to each taxpayer. Eligibility for specific forms of tax aid, for example provides in compromise, is commonly limited to those that can reveal money hardship. Likewise, tax resolution procedures may possibly differ depending on the taxpayer's money circumstance and the character of their tax credit card debt.

Despite these troubles, the prospective great things about tax relief and tax resolution are significant. For lots of taxpayers, these techniques can necessarily mean the difference between money stability and ongoing economic worry. The case of Doe vs. Tax Rise Inc. can be a testomony to the efficiency of those procedures when applied appropriately. By getting a proactive method of tax aid and tax resolution, taxpayers can manage their tax liabilities a lot more properly and steer clear of the severe implications of unresolved tax financial debt.

In conclusion, tax relief and tax resolution are crucial parts of productive tax administration. They supply taxpayers Along with the applications and strategies required to reduce their tax liabilities and take care of tax disputes. The situation of Doe vs. Tax Increase Inc. illustrates the value of these approaches in obtaining favorable outcomes. By staying informed, seeking professional aid, and performing immediately, taxpayers can navigate the complexities in the tax method and secure the economical reduction they want. No matter whether by means of tax credits, deductions, or negotiated settlements, tax relief and tax resolution present you with a pathway to fiscal balance for those struggling with tax troubles.

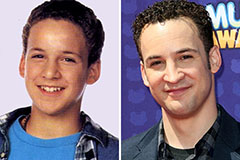

Ben Savage Then & Now!

Ben Savage Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!